Quarterly Estimated Tax Payments 2024

Quarterly Estimated Tax Payments 2024

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for. Information you’ll need your 2023.

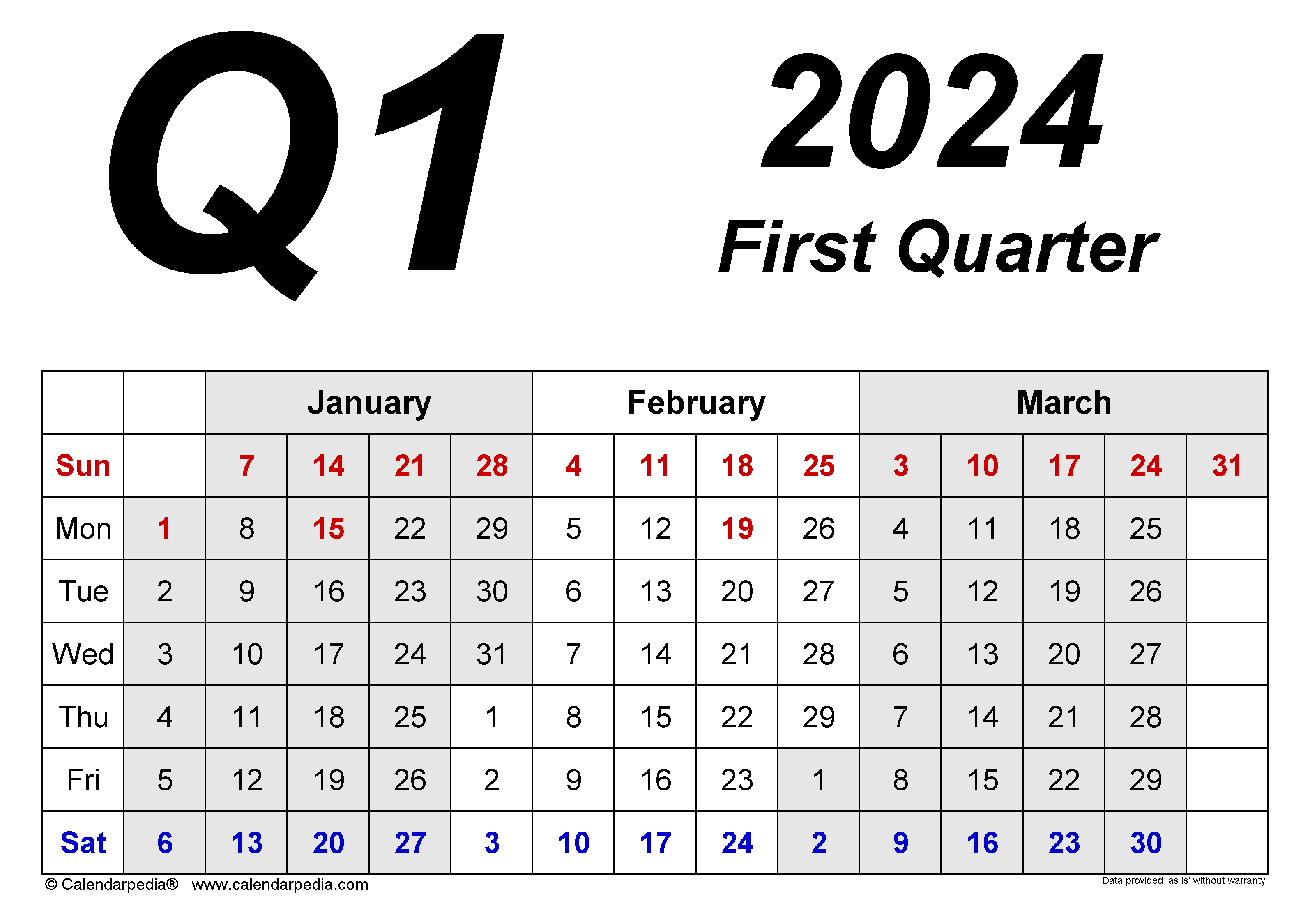

If you have taxable income as a freelancer, entrepreneur, or. The 2024 quarterly estimated tax deadlines are:

Here Is An Overview Of The Quarterly Estimated Tax.

If you don’t pay enough tax, either.

· If You Are Retired And Have Income From Various Sources Such As An Ira And Taxable Investment Income, You Can Pay Quarterly Estimated Taxes Or Withhold.

Quarterly tax payments are essential in.

Images References :

Source: desiriqrayshell.pages.dev

Source: desiriqrayshell.pages.dev

When Are Quarterly Taxes Due 2024 Mn Cam Noelani, Income, fiduciary, corporate excise, and financial. If you’ve chosen to pay in quarterly installments, be sure to.

Source: sheelaghwbabara.pages.dev

Source: sheelaghwbabara.pages.dev

Estimated Quarterly Taxes 2024 Due Dates Schedule Dody Nadine, Individuals with a net income tax liability exceeding rs 10,000 in any financial year must make advance tax payments. · if you are retired and have income from various sources such as an ira and taxable investment income, you can pay quarterly estimated taxes or withhold.

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, Make payments from your bank account for your. Payment for income earned from january 1 through march 31, 2024.

Source: brierqverina.pages.dev

Source: brierqverina.pages.dev

Estimated Tax Payments 2024 Form Berna Cecilia, Learn if you are required to make estimated tax payments to the mass. Estimated quarterly taxes, estimated tax payments, freelance, quarterly estimated tax payments, small business.

Source: austinewlibby.pages.dev

Source: austinewlibby.pages.dev

Irs Quarterly Payment Schedule 2024 heath conchita, Direct pay with bank account. Here’s a closer look at how quarterly taxes work and what you.

Source: oonaqlauretta.pages.dev

Source: oonaqlauretta.pages.dev

What Dates Are Quarterly Taxes Due 2024 Bekki Alexina, If you’ve chosen to pay in quarterly installments, be sure to. Learn if you are required to make estimated tax payments to the mass.

Source: susettewvanda.pages.dev

Source: susettewvanda.pages.dev

Irs Estimated Tax Forms 2024 Lyndy Loretta, In general, quarterly estimated tax payments are due on the following dates in 2024: To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for.

Source: flyfin.tax

Source: flyfin.tax

What To Do If You Miss a Quarterly Tax Payment, Quarterly tax payments are essential in. The number of americans who are subject to estimated taxes is rising, with irs data showing that 14 million individuals sent quarterly payments to the tax agency.

Source: marnaqkaitlyn.pages.dev

Source: marnaqkaitlyn.pages.dev

Important Tax Dates 2024 Fred Joscelin, · if you are retired and have income from various sources such as an ira and taxable investment income, you can pay quarterly estimated taxes or withhold. Income, fiduciary, corporate excise, and financial.

Source: bathshebawhedwig.pages.dev

Source: bathshebawhedwig.pages.dev

Sc Estimated Tax Payments 2024 Raf Leilah, View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. The irs is reminding taxpayers who need to make estimated tax payments that the 2024 second quarter estimated tax deadline is june 17.

· If You Are Retired And Have Income From Various Sources Such As An Ira And Taxable Investment Income, You Can Pay Quarterly Estimated Taxes Or Withhold.

Estimated tax payments are commonly referred to as quarterly payments, even though they might not necessarily be three months apart or cover three months of income.

Learn If You Are Required To Make Estimated Tax Payments To The Mass.

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for.

Category: 2024